Renters could find it more difficult to find properties in the next year or two as landlords struggle with higher mortgage rates, MPs have heard.

Ray Boulger, from mortgage broker John Charcol, said landlords may be more reluctant to hold on to buy-to-let properties which could have a “serious impact” on the availability of homes.

He said the situation was particularly acute in London and South East England.

The Commons Treasury Committee has been hearing from mortgage experts.

The session was designed to review the state of the market during and following the upheaval of recent weeks, partly as a result of former chancellor Kwasi Kwarteng’s mini-budget.

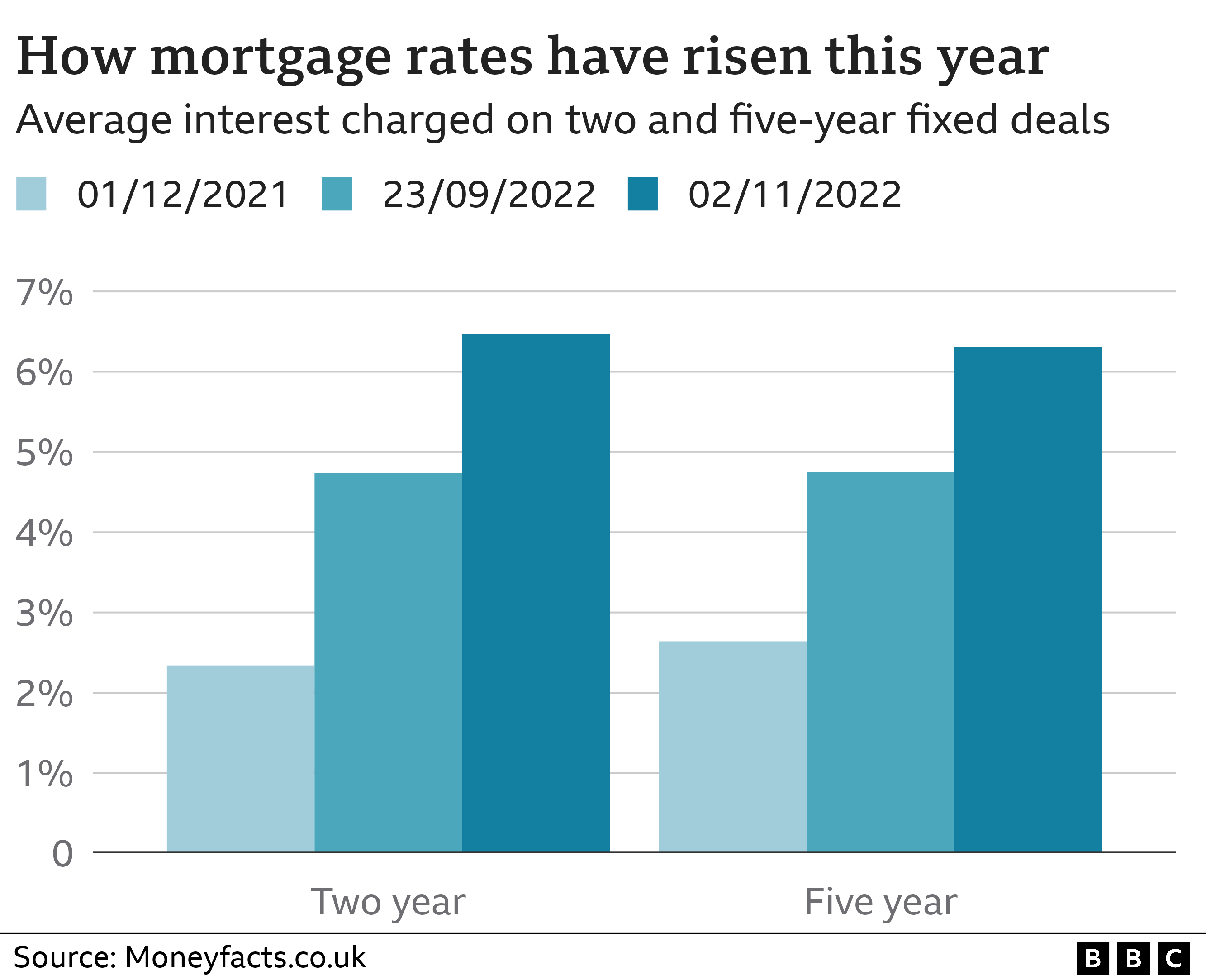

New fixed-rate mortgages have risen sharply in cost during the year, and jumped in the aftermath of the mini-budget, when investors were spooked by big tax cut pledges that were set out without specifying how they would be paid for.

Mr Boulger said that the buy-to-let sector was likely to see more “stress” than other areas of the mortgage market.

He said that some landlords would find it difficult in some areas to secure a mortgage of more than 50% or 60% of a property’s value.

That, added to tax changes which have led some landlords to consider selling up, would reduce availability for tenants, he said.

About 40% of landlords have a mortgage on their rental properties.

PRICES SET TO FALL

Earlier this week, the Nationwide Building Society said that UK house prices fell by 0.9% month-on-month in October, the first monthly decline in 15 months.

The drop was the largest since June 2020, at the height of the pandemic, the mortgage lender said.

Chris Rhodes, chief finance officer from the Nationwide, said that the outlook for the housing market was “very uncertain”.

Mr Boulger forecast a 10% to 15% drop in house prices from peak to trough, partly because the ability to borrow was being curtailed.

Joanna Elson, chief executive of debt charity the Money Advice Trust, called for a public awareness campaign to urge people to seek help if they were struggling to make mortgage repayments.

She also called for some of the requirements on financial support to help with mortgage payments to be eased.

There is also significant pressure on renters, which made up the majority of those seeking help from the charity, she told MPs.

People tended to prioritise paying for “the roof over their heads”, she said.

Figures seen recently by the BBC suggest that people under 30 are now spending more than 30% of their pay on rent – marking a five-year high.

Experts said this level of rental costs is unaffordable and warned that younger tenants could face a difficult winter as costs and energy bills mount.