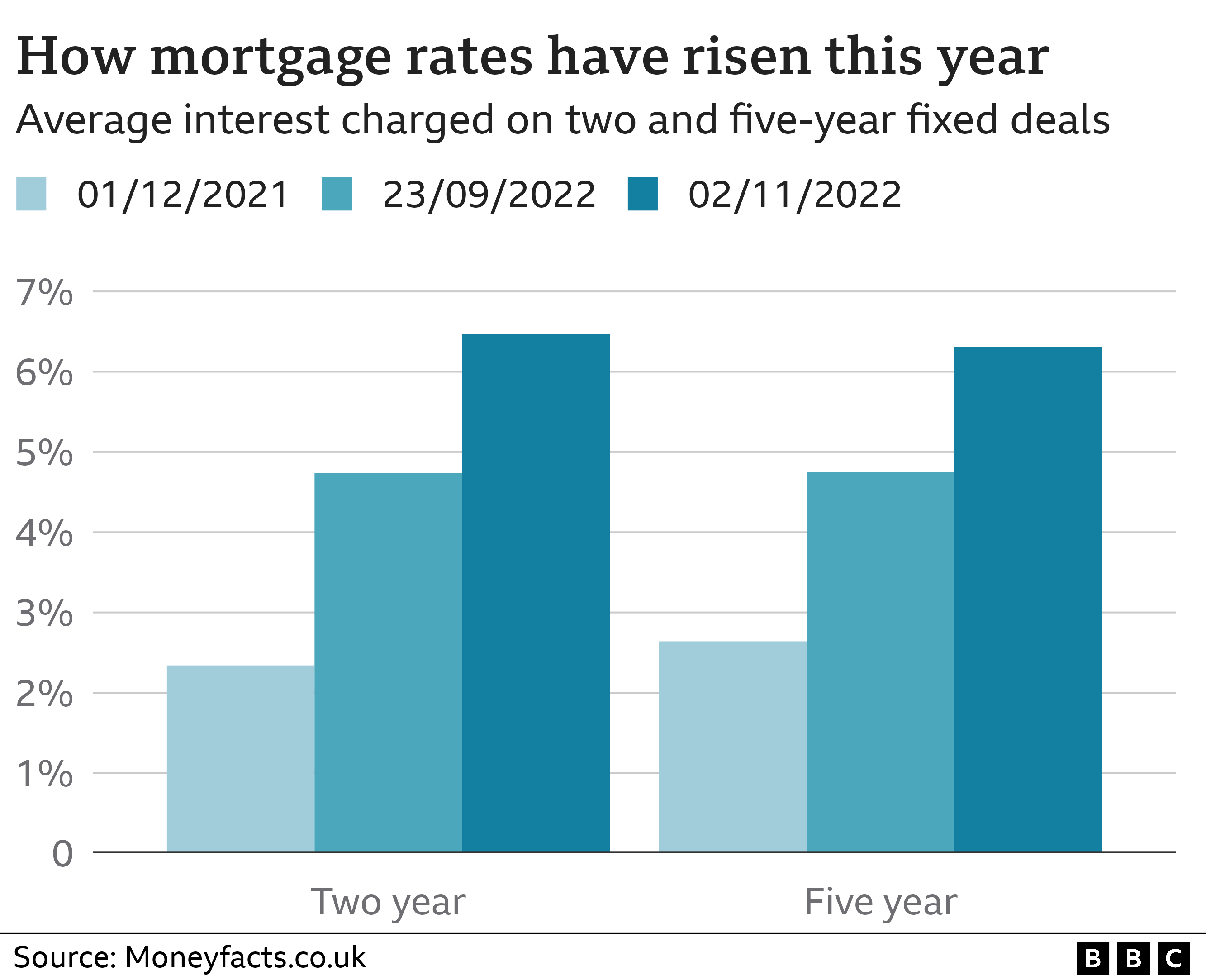

The average interest rate charged by mortgage lenders has hit its highest level for 14 years, adding to the cost-of-living pressure.

So what can those struggling to make repayments do – and how must their mortgage provider help out?

WHAT ARE TRACKER, VARIABLE AND FIXED MORTGAGES?

There are different types of mortgages – all of which have been becoming more costly in recent months.

- Tracker rates rise and fall in line with the benchmark interest rate the Bank of England sets eight times a year

- Standard variable rates (SVR) change at the discretion of the lender – a decision influenced by the Bank of England’s rate but not directly linked

- Fixed rates, used by about three-quarters of mortgage customers, are set for a certain number of years – usually two or five – after which borrowers remortgage or are automatically moved to an SVR

Mortgage rates have been rising, so the 1.6 million people on tracker or variable deals have been paying much more than a year ago.

The estimated 300,000 homeowners coming to the end of a fixed deal every three months are also facing a much higher monthly bill.

Typically, they could end up paying an extra £3,000 a year, the Bank of England said.

WHEN WILL MORTGAGE RATES FALL?

That is difficult to answer. Analysts expect Bank of England interest rates to peak at about 4.75% next year.

For anyone on tracker deals, at least, that means higher repayments to come.

Mortgage brokers say fixed-rate deals may have stopped going up for now – and may start to fall slightly as the year turns.

However, a decade or so of ultra-low mortgage rates – which many homeowners have become accustomed to – is clearly over.